Riding the Solana Shitcoin Waves: Simple Trading and Auto-Sell Strategies for Beginners#

Guide G001 · Solana Shitcoin Trading Series

The Solana shitcoin ecosystem is a nonstop rollercoaster. New tokens appear every minute, prices move like they’re on caffeine, and fortunes are made (and lost) faster than you can refresh a chart.

This guide breaks down the simple, foundational strategies every beginner needs to survive the chaos:

- How to enter trades quickly

- How to avoid fake tokens

- How to size your positions

- How to use auto-sell tools

- How to protect yourself from instant dumps

Whether you’re brand new or a seasoned degen, this is the starting point for every guide in this series.

1. Simple Shitcoin Trading: The Art of the Quick Flip#

Solana shitcoin trading is all about speed and discipline. Tokens move insanely fast, and profits (or losses) can happen in seconds.

Here’s how to approach fast trading without getting destroyed:

1.1 Step 1: Find New or Active Tokens#

Use scanners like:

- Dexscreener

- Birdeye

Look for:

- Fresh launches

- At least $3,000+ liquidity (see: Liquidity)

- Steady volume

- A chart that isn’t an instant rug

Avoid anything with suspiciously low liquidity, dev wallets holding everything, or charts that look like ski slopes.

1.2 Step 2: Verify the Token Ticker#

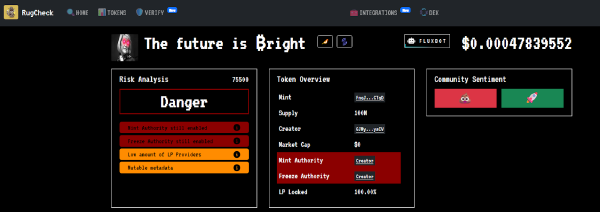

Solana is full of fake, cloned, and copycat tokens.

Example:

You search for $WIF, see two versions, and accidentally buy the wrong one.

That one gets rugged.

To avoid this:

- Verify mint address

- Check the volume

- Compare chart age

- Look at social channels (optional but helpful)

1.3 Step 3: Set Your Risk Amount#

Before buying anything:

Decide exactly how much SOL you’re willing to lose.

A good range for beginners:

- 0.1 to 1 SOL per trade

This prevents emotional decisions and helps you trade consistently.

1.4 Step 4: Execute Quickly#

In Solana shitcoins:

- Seconds matter

- Hesitation kills profits

- Delayed execution often means buying tops

Once you’ve verified liquidity and ticker → enter your trade immediately.

2. Auto-Sell: Your Safety Net in the Shitcoin Sea#

Manual trading is fun, but unless you want to stare at charts all day, you need automation.

Auto-sell tools allow you to:

- Take small profits automatically

- Prevent large losses

- Remove emotional decision-making

- Trade efficiently even while AFK

This is your first real trading system.

3. How to Use Auto-Sell Like a Pro#

Here’s a simple setup that works well for beginners:

3.1 Enable Auto-Sell Immediately#

Do this right after buying.

Most beginners skip this step and end up watching a 2× pump turn into a 40% loss because they “thought it had more room.”

If you automate nothing else - automate this.

3.2 Set Profit Target (% Take Profit)#

Recommended starting points:

- 5–30% profit target

Why this range?

- Small gains compound fast

- Big pumps often reverse instantly

- You avoid over-holding meme coins

Remember:

Pigs get fat. Hogs get slaughtered.

3.3 Set Loss Limit (% Stop Loss)#

Your emergency exit button.

A smart beginner setup:

- 5–10% stop loss

This ensures:

- You never get blown up by sudden dips

- Your losses are controlled

- You live to trade another day

Learn more about stop losses in the glossary:

Stop Loss

3.4 Optional: Partial Auto-Sell (Advanced)#

Some traders prefer multi-level exits.

Example:

- 20% sold at 10% profit

- 30% sold at 25% profit

- 50% sold at 50% profit

This is called grid selling (see: Grid Sell).

We cover advanced grid systems in:

- Trailing Stops Guide (G004)

- Breakeven Stops Guide (G005)

For beginners → stick to simple full auto-sell.

4. Real Example: Auto-Sell in Action#

Here’s a real trade (structure preserved):

Position:

- Bought: 1 SOL worth of

$PssyMnstr

Purchase transaction:

View Purchase TX on Solscan

Auto-sell settings:

- Take profit: 10%

- Stop loss: 5%

Result:

- Went to the bathroom

- Came back

- Bot sold at 10% profit

Sell transaction:

View Sell TX on Solscan

Final result:

Turned 1 SOL → 1.1 SOL in ~5 minutes.

Not bad for a beginner-friendly setup.

5. The Degen Philosophy#

At the end of the day:

- Trading shitcoins is gambling with structure

- You should be in and out fast

- No emotional attachment

- No “wen moon” delusion

- No disabling stop losses

- No bag holding until you’re broke

You’re here to play the game smart, not emotionally.

You set your rules → you follow them → you leave with profit or minimal losses.

That’s the difference between a degen and a profitable degen.

Need Help With Terminology?#

Visit the full Crypto Trading Glossary:

👉 /glossary/

6. What’s Next in This Series#

Now that you understand:

- Fast entries

- Auto-sell basics

- Stop losses

- Position sizing

- Beginner risk management

You’re ready for the next step:

We’ll cover:

- Static stop

- Trailing stop

- Breakeven stop

- Why bots make them 10× more powerful

Automate These Strategies With Roo#

Take the load off your hands. Roo offers fast Solana trading automation with grid sells and advanced stop losses.

Try Roo