Static Stop Loss: Your First Line of Defense in the Solana Shitcoin Warzone#

Guide G003 · Solana Shitcoin Trading Series

Static stop loss is the foundation of every good crypto risk management system. It doesn’t do anything fancy, it doesn’t move, and it doesn’t adapt. But in the high-volatility battleground of Solana shitcoins, a well-placed static stop loss can save your entire wallet from becoming someone else’s liquidity.

This guide breaks down what static stop losses are, why they matter, and how to set them correctly, especially if you’re using a crypto trading bot or automation.

1. What Is a Static Stop Loss in Crypto Trading?#

Let’s keep this simple and beginner-friendly.

A static stop loss (see: Static Stop Loss) is:

A fixed exit point you set before entering a trade. If the price drops to this level, your position automatically closes.

It’s called static because:

- It does not move

- It does not adjust

- It stays exactly where you placed it

It’s like placing a bouncer at the door of your trade and telling him:

“If this token drops below X, kick it out. No discussion. No mercy.”

Why beginners love static stops#

- They’re predictable

- They’re simple

- They don’t require constant monitoring

- They’re supported by every trading bot and platform

2. Why Static Stop Losses Are Essential for Solana Shitcoins#

Solana’s meme economy is basically a casino strapped to a rocket engine.

Tokens can:

- Moon instantly

- Rug instantly

- Move 20% in a single wick

- Fake pump then crash

- Reverse direction violently

A static stop loss protects you from:

✔ Huge losses during sudden dumps#

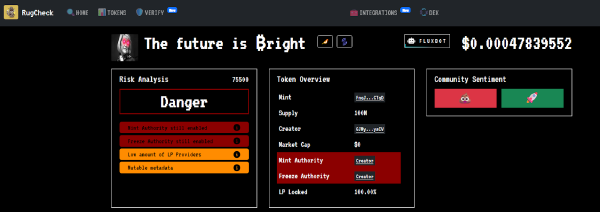

✔ Rugs and liquidity drains (see: Liquidity)#

✔ Emotional panic-selling#

✔ Market noise and distraction#

✔ Decision paralysis during volatility#

If you’re trading Solana shitcoins without a static stop loss, you’re gambling, not trading.

3. How to Use Static Stop Loss Like a Pro#

Static stop losses are simple, but using them well is where the skill comes in.

Here’s how to optimize them.

3.1 Step 1: Know Your Token’s Volatility#

Different tokens behave differently.

High-volatility tokens: Memecoins, new launches, hype tokens

→ Set a wider stop loss (e.g., 15–25%)Lower-volatility tokens: Established micro-caps, steady volume

→ You can use a tighter stop loss (e.g., 5–12%)

If you set a tight stop on a token that moves like a rabid squirrel, you’ll get stopped out constantly, losing small amounts repeatedly for no reason.

3.2 Step 2: Use Key Support Levels#

Static stop losses become more reliable when placed below obvious support zones.

Example:

If the chart shows:

- Higher lows

- A consolidation floor

- A recent bounce level

Place your stop below that area, not inside it.

This reduces “fake-out” losses from normal volatility.

3.3 Step 3: Use Percentages, Not Fixed Price Points#

This is critical.

Percentages adapt to the price and your position. Fixed numbers don’t.

A 20% stop loss works equally well for:

- 0.1 SOL trades

- 1 SOL trades

- 10 SOL trades

But a fixed price target can be completely meaningless after a volatility spike.

3.4 Step 4: Avoid Being Too Tight (or Too Loose)#

Too tight:

- You get stopped out constantly

- Perfectly healthy volatility kills your trade

Too loose:

- You lose way more than planned

- You undermine your entire risk strategy

The goal is:

A stop that protects you without kicking you out of every pump.

The sweet spot on Solana shitcoins is usually:

- 10–25% for volatile tokens

- 5–12% for more stable ones

4. Why Static Stop Loss Works Best With Automation#

Here’s the truth:

Manually managing static stop losses is fine… until it isn’t.

You will eventually:

- Forget to place a stop

- Cancel a stop loss emotionally

- Move your stop “just a little”

- Hesitate during volatility

- Miss a sudden dump while away from the screen

Crypto trading bots (see: Trading Bot) don’t make these mistakes.

Bots are better because:#

- Bots never sleep

- Bots don’t get emotional

- Bots follow rules perfectly

- Bots execute faster than any human

- Bots protect you from yourself

5. Example: How a Bot Handles a Static Stop Loss#

Let’s imagine you enter a Solana shitcoin at:

- Entry price: 1.00 SOL

- Static stop loss: 0.85 SOL (-15%)

Bot behavior:

- You enter the trade

- Bot instantly places a stop at 0.85

- Price pumps to 1.12 → nothing changes

- Price dumps back to 0.84 → bot exits instantly

- You’re protected, even if you’re asleep

Meanwhile, the manual trader is thinking:

“Bro… it’ll bounce.”

It doesn’t bounce.

Static stop loss saves your ass.

6. The Degen’s Dilemma: “Is This Paper Hands?”#

Let’s be real:

Not using stop losses isn’t diamond hands.

It’s:

- Hopium

- Cope

- Delusion

- And eventually… poverty

You can’t win every trade.

You can win the long game by avoiding catastrophic losses.

Static stop loss isn’t about being scared.

It’s about being smart.

Degens who use static stops live to fight another day.

Degens who don’t… get liquidated emotionally and financially.

7. Wrapping It All Up#

Static stop loss is the first layer of your risk management system.

It’s simple, powerful, and absolutely essential in the Solana shitcoin warzone.

Remember:

- Use percentages

- Understand volatility

- Avoid emotional decisions

- Automate your stop loss logic

Once you master static stop losses, you can layer more advanced tools like:

- Trailing stops

- Breakeven stops

- Tiered exits

- Hybrid manual + bot strategies

Static stop loss is where real crypto risk management begins.

Stay smart. Stay disciplined. Stay degen.

May your stops trigger exactly when they should.

Need Help With Terminology?#

Visit the full Crypto Trading Glossary:

👉 /glossary/

What’s Next in This Series?#

Continue to G004 – Trailing Stop Loss: Ride Pumps Without Getting Dumped:

Automate These Strategies With Roo#

Take the load off your hands. Roo offers fast Solana trading automation with grid sells and advanced stop losses.

Try Roo